If the current situation, of what will happen when the UK tries to extract its laws and trading relationships from Europe, is likely to affect your business, then take action now. Don’t fall into the same trap as the exit proponents have, all sound bites and emotional hot air, with no strategy or thought in planning how to build a better stronger country. Will they cause panic and loss of confidence in the economy, it has certainly started out that way?

If you think the path ahead is going to have a lot of twists and turns, then perhaps it’s time to take stock of what options you have available, for your business to survive. There’s no going back. Ask yourself these questions about your business status, during Brexit.

- What are the threats to my business operation?

- What impact will these threats have on my profitability and business activity?

- How much time do I have to prepare for these changes?

- What options do I have to remove or mitigate any negative effects?

- Can I change these threats into a positive outcome, where I will be better off?

In the 2008 crash and downturn smaller businesses tended to take the biggest hit, having gone through a traumatic period of downsizing and reduction in activity. The changes in access to finance and credit also probably had a big part to play with business survival, offering no safety net. Bank lending probably changed forever becoming more risk-averse after the recovery than before.

Limited traditional lending has led to a steep rise in alternative lending and fund raising for start-smaller companies, start-ups in particular. The increase in angel investors attracted by tax concessions, venture capital funds or the exponential rise of social funding platforms like peer to peer funding, and crowd funding, is a strong indication of this shift. This may be an option to overcome this period of uncertainty, by planning the funding stages for your business it makes you attractive to investors.

At present supplier relationships with outside countries are being affected by currency fluctuations of the pound and this uncertainty is likely to continue with a number of global currencies weakening. However, some of the bigger threats will remain a local, through a lack of confidence, leading to delayed decision making, a general ‘limbo’ until the new government changes become clearer. Is this the time to look at other growth markets to offset local market shrinkage?

Planning Ahead

The big question is ‘are you going to do something about this situation now’ or simply bumble along or set a new direction. Periods of turmoil and recession have been known as a time of ‘creative destruction’ where big leaps forward are made, in the way we do things.

What strategy will you be adopting?

- Dither/ Do nothing/ Organisational paralysis

- Minor efficiency gains/ Incremental adjustments/ Essentially do what you did before

- Turn crisis into an opportunity/ Develop a stronger business model/ Positive change of direction

Some of the observations from the recession, after the 2008 crash, indicated emerging, successful companies were those that had a management strong enough to reinvent their offering, deliver their planning goals and focus on delivering superior customer value. Industry sectors that were devastated by the financial upheaval all had survivors who prospered, irrespective of the size of the company, market size, location and other factors normally considered as critical to success.

The strategies that worked for companies in the recession are not what you might expect.

- Putting more value into your offering, to make it better for your customer.

- Making it easier for customers to access your products. Online and offline combinations.

- Using your customer data to leverage specific information in terms of focused marketing directed towards specific products.

- Innovating processes to design out, production and delivery costs

- Investing in the business, it is often cheaper, uses reserves efficiently and puts you in a premier position for recovery

- Milking the existing assets to squeeze out operational efficiency

Read the details of the companies that used these approaches. Bloomberg article

Here are some tools that will allow you to look at your current situation and start thinking about the way forward. First carry out an Enterprise Status Assessment, with a critical business colleague to see how fit you are at present, in the core functions of your business. I can send you back the details to see how you compare across your company activities and look at areas to strengthen.

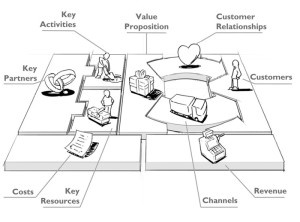

The second tool is the Business Canvas Model from Strategyzer. This is a simple but effective tool for describing how your business works now and allow you to analyse the effect of threats. By mapping new models of what a future business may look like it will become clearer what direction to take.

By engaging with a third party to look at your business, without inbuilt preconceptions and a detailed understanding of how it works now, frees up the ability to look at new business opportunities. It allows more creative strategic options to be considered, at a high level, before getting into the detail and planning stages.

Once a strategy is set then all the business activities are planned in logical steps to achieve the goals, leading to efficient use of the resources available. My details are here when you want to move forward.

Recent Comments